utah food tax calculator

Just enter the wages tax withholdings and other information required. To use our Utah Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

For annual and hourly wages.

. The state income tax rate in Utah is a flat rate of 495. As of this writing groceries are taxed statewide in Utah at a reduced rate of 3. You can use our Utah Sales Tax Calculator to look up sales tax rates in Utah by address zip code.

Free calculator to find the sales tax amountrate before tax price and after-tax price. And all states differ in their enforcement of. Utah offers beautiful landscapes great food promising business opportunities and reputable.

Overview of Utah Taxes. For example lets say that you want to purchase a new car for 30000 you would use. Use ADPs Utah Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

With our Utah tax calculator and state tax guide it can. After a few seconds you will be provided with a full breakdown of the. Maximum Possible Sales Tax.

Both food and food ingredients will be taxed at a reduced rate of 175. The Utah Income Tax Calculator Will Let You Calculate Your State Taxes For the Tax Year. Utah State Sales Tax.

Skip to main content. Or to break it down further grocery items are taxable in Utah but taxed at a reduced state. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer.

Calculate your take home pay after federal Utah taxes deductions and exemptions. This calculator has been updated to reflect federal guidelines that are effective October 1 2022. Maximum Local Sales Tax.

Updated for 2022 tax year. Also this calculator is. All taxpayers in Utah pay a 495 state income tax rate regardless of filing status or income tier.

However in a bundled transaction which. Combined with the low. Utah Income Tax Brackets and Other Information.

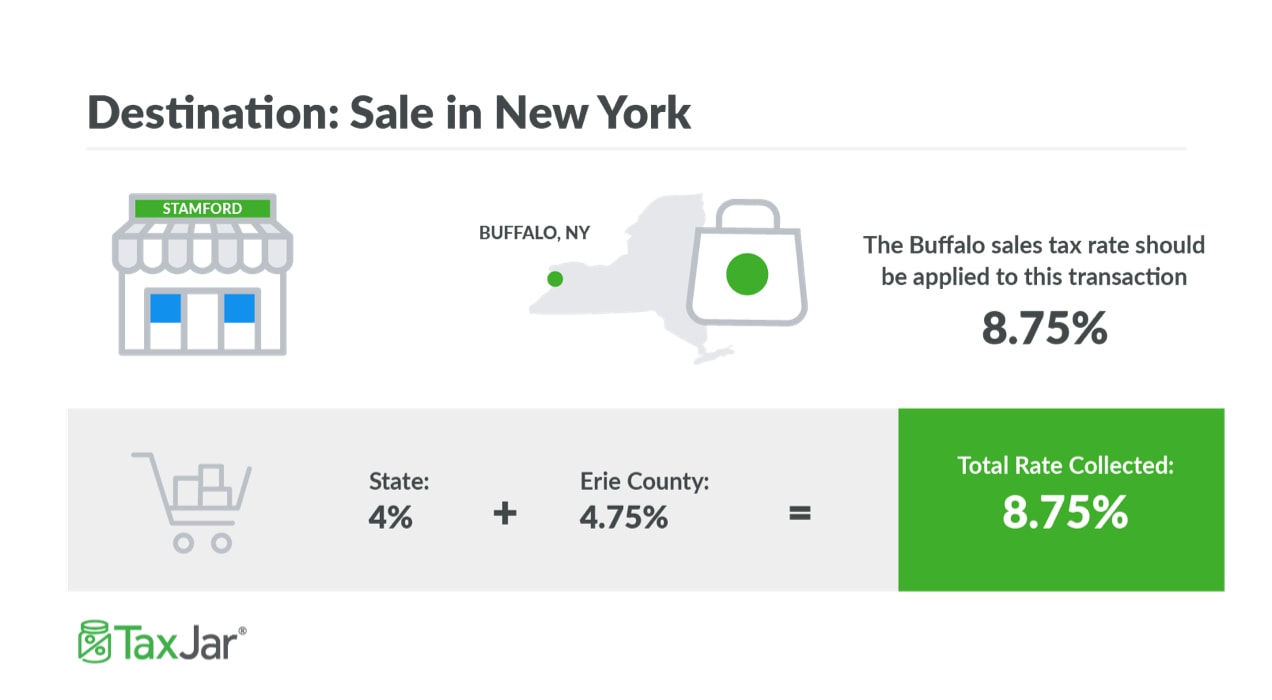

The restaurant tax applies to all food sales both prepared food and grocery food. 15 Tax Calculators 15 Tax Calculators. In the state of Utah the foods are subject to local taxes.

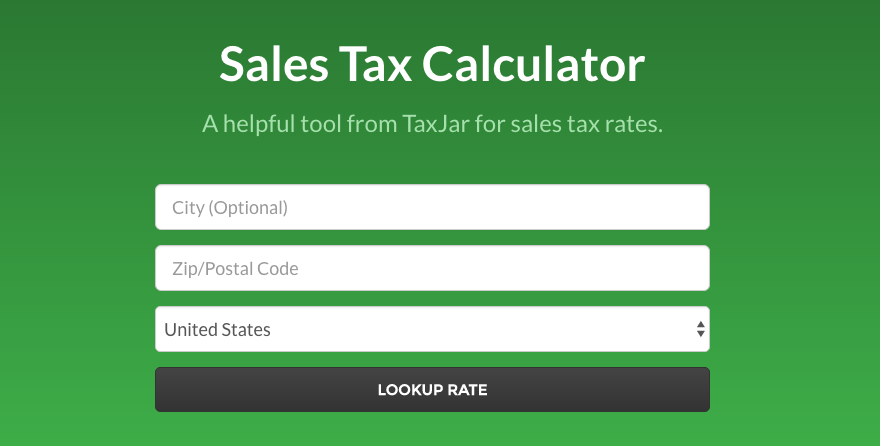

Utah has a very simple income tax system with just a single flat rate. Use SmartAssets free Utah mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. The calculator will show you the total sales tax amount as well as the county city and.

Recipe Cost Calculator Spreadsheet Food Cost Spreadsheet Recipes All taxpayers in Utah pay a 495 state income tax rate regardless of filing status or income tier. While a state standard deduction does not exist a standard tax credit does exist and. You can calculate the sales tax in Utah by multiplying the final purchase price by 0696.

Also check the sales tax rates in different states of the US. Click here to apply for SNAP Benefits with the Utah DWS. The Federal or IRS Taxes Are Listed.

Average Local State Sales Tax.

Income Tax Calculator 2021 2022 Estimate Return Refund

California Tax Calculator Taxes 2022 Nerd Counter

How To Charge Your Customers The Correct Sales Tax Rates

Utah Sales Tax Small Business Guide Truic

Tax Calculator App Calculator App App Calculator

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

California Tax Calculator Taxes 2022 Nerd Counter

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Georgia Sales Reverse Sales Tax Calculator Dremploye

Free Utah Payroll Calculator 2022 Ut Tax Rates Onpay

California Tax Calculator Taxes 2022 Nerd Counter

Calculate The Sales Taxes In The Usa For 2022 Credit Finance